Best courses after 12th Commerce: Ultimate Guide

Commerce is a diverse field offering myriad opportunities for students who have completed their 12th standard. With a foundation in subjects like economics, accountancy, and business studies, commerce students are well-equipped to pursue various professional courses and careers. This blog aims to provide a comprehensive list of the best courses after 12th commerce, including job-oriented courses and career options for commerce graduates.

Why Choose Commerce After 12th?

Commerce is an ideal stream for students interested in the financial and business sectors. It provides a strong understanding of economic policies, trade, market fluctuations, and the basics of accounting and finance. This knowledge is essential for numerous professional courses and lucrative careers. The field of commerce is ever-evolving, with a growing demand for skilled professionals in finance, accounting, management, and entrepreneurship.

Top Courses for Commerce Stream

After completing 12th grade with a commerce stream, students have a plethora of courses to choose from that can shape their careers in various fields. Many of the available courses after 12th commerce which helps students to shape our career. Popular options of courses include Bachelor of Commerce (B.Com), which offers a strong foundation in accounting, finance, and business studies. Chartered Accountancy (CA) is another prestigious course that prepares students for a career in auditing, taxation, and financial management.

For those interested in management, a Bachelor of Business Administration (BBA) provides insights into business operations and management principles. Other notable courses include Company Secretary (CS), Cost and Management Accounting (CMA), and Economics (BA in Economics). Emerging fields such as Bachelor of Management Studies (BMS) and Bachelor of Financial Markets (BFM) are also gaining popularity. These courses open doors to various career opportunities in finance, banking, management, and entrepreneurship, equipping students with the skills and knowledge needed to thrive in the competitive business world.

1. Bachelor of Commerce (B.Com)

Overview: A Bachelor of Commerce (B.Com) is an undergraduate degree focusing on commerce, business, and management-related subjects. The program typically spans three to four years, depending on the country and institution, and it aims to provide students with a solid foundation in various business disciplines.

Duration: 3 years

Key Subjects in B.Com:

- Accounting: Financial and managerial accounting principles, auditing, and taxation.

- Finance: Investment analysis, corporate finance, financial markets, and financial management.

- Economics: Microeconomics, macroeconomics, and economic policy.

- Marketing: Market research, consumer behavior, and strategic marketing.

- Management: Organizational behavior, human resource management, and strategic management.

- Business Law: Commercial law, corporate law, and legal aspects of business.

- Statistics and Business Mathematics: Quantitative techniques and data analysis.

- Information Systems: Business technology, information management, and e-commerce.

Specializations:

B.Com programs often offer specializations or majors in specific areas such as:

- Accounting and Finance

- Marketing

- International Business

- Entrepreneurship

- Human Resources

- Information Technology

Career Opportunities:

Graduates with a B.Com degree have various career opportunities in sectors such as:

- Accounting and Auditing

- Banking and Finance

- Marketing and Sales

- Human Resource Management

- Consulting

- Entrepreneurship

- Government and Public Administration

Further Studies:

Many B.Com graduates pursue further education, including:

- Master of Commerce (M.Com)

- Master of Business Administration (MBA)

- Chartered Accountancy (CA)

- Certified Public Accountant (CPA)

- Other professional certifications and diplomas in specialized areas.

The B.Com degree equips students with the knowledge and skills necessary for a successful career in business and commerce, providing a strong foundation for further professional growth and development.

2. Bachelor of Business Administration (BBA)

Overview: The Bachelor of Business Administration (BBA) is an undergraduate degree designed to provide students with a comprehensive understanding of business and management principles. This degree typically spans three to four years, depending on the country and institution, and it is one of the most popular undergraduate programs for students interested in pursuing careers in business, management, finance, and related fields.

Duration: 3 years

Core Curriculum

The BBA curriculum is structured to give students a broad exposure to various aspects of business. Core subjects typically include:

- Accounting: Fundamental principles of accounting, financial reporting, and analysis.

- Finance: Basics of financial management, investment strategies, and market analysis.

- Marketing: Principles of marketing, consumer behavior, market research, and advertising.

- Management: Organizational behavior, human resource management, and strategic management.

- Economics: Microeconomics, macroeconomics, and economic policy.

- Business Law: Legal environment of business, contracts, and corporate law.

- Information Systems: Role of information technology in business, data management, and e-commerce.

- Operations Management: Production management, supply chain logistics, and quality control.

- Business Ethics: Ethical issues in business, corporate social responsibility, and sustainability.

- Quantitative Methods: Statistics, business mathematics, and decision-making models.

In addition to these core areas, students often have the opportunity to choose electives and specialize in specific fields such as international business, entrepreneurship, real estate, or healthcare management.

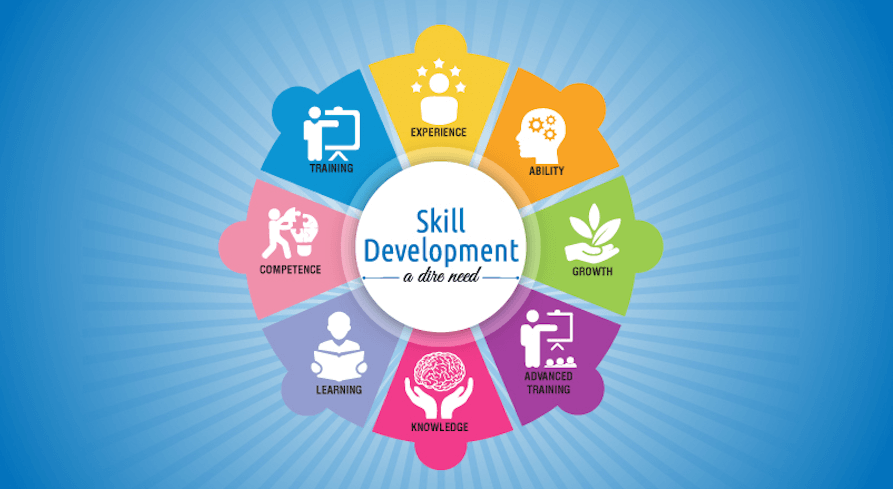

Skill Development

The BBA program emphasizes the development of various skills essential for a successful business career. These skills include:

- Analytical Skills: Ability to analyze data, interpret financial statements, and make informed decisions.

- Communication Skills: Proficiency in written and verbal communication, presentation skills, and interpersonal communication.

- Leadership Skills: Understanding leadership theories, team management, and motivational strategies.

- Problem-Solving Skills: Ability to identify problems, generate solutions, and implement strategies effectively.

- Technical Skills: Familiarity with business software, information systems, and digital tools.

Internships and Practical Experience

Most BBA programs incorporate internships or practical projects to provide students with real-world experience. These opportunities allow students to apply theoretical knowledge in actual business settings, develop professional networks, and gain insights into their future career paths. Internships are often facilitated by the university’s career services and may be required for graduation.

Career Prospects

A BBA degree opens doors to a wide range of career opportunities in both the private and public sectors. Graduates can pursue roles such as:

- Business Analyst: Analyzing market trends, business processes, and financial performance to advise on business strategies.

- Marketing Manager: Developing marketing campaigns, managing brand image, and conducting market research.

- Financial Analyst: Evaluating financial data, investment opportunities, and economic trends.

- Human Resources Manager: Managing recruitment, training, employee relations, and compliance with labor laws.

- Operations Manager: Overseeing production, logistics, and supply chain management.

- Sales Manager: Leading sales teams, developing sales strategies, and achieving revenue targets.

- Entrepreneur: Starting and managing one’s own business.

Graduates may also choose to pursue advanced degrees such as a Master of Business Administration (MBA) or specialized master’s programs in finance, marketing, or international business to further enhance their career prospects.

Global Perspective

The BBA program often includes a global perspective, preparing students to operate in a diverse and interconnected world. This may involve studying international business environments, cross-cultural management, and global market dynamics. Many universities offer study abroad programs or international exchange opportunities to enrich students’ educational experience and broaden their cultural understanding.

3. Chartered Accountancy (CA)

Overview: Chartered Accountancy (CA) is a professional accounting qualification that is recognized globally for its rigor and comprehensive coverage of financial and business-related subjects. It is highly respected and valued in the fields of finance, accounting, and business management. Here’s a detailed overview:

Duration: Varies (generally around 5 years, including articleship)

History and Global Recognition

The profession of Chartered Accountancy originated in Scotland in the mid-19th century. The title “Chartered Accountant” was first granted by the Edinburgh Society of Accountants in 1854. Since then, the qualification has spread globally, with various countries establishing their own institutes and regulatory bodies.

Regulatory Bodies and Institutes

Different countries have their own governing bodies for Chartered Accountants, such as:

- Institute of Chartered Accountants of Scotland (ICAS)

- Institute of Chartered Accountants in England and Wales (ICAEW)

- Chartered Professional Accountants of Canada (CPA Canada)

- Institute of Chartered Accountants of India (ICAI)

- Chartered Accountants Australia and New Zealand (CA ANZ)

These institutes set the educational standards, conduct examinations, and ensure that members adhere to professional ethics and standards.

Qualification Process

Becoming a Chartered Accountant involves a combination of rigorous academic study, practical experience, and passing a series of challenging exams. The general pathway includes:

- Educational Requirements:

- Prospective CAs usually need a relevant undergraduate degree or an equivalent qualification. In some countries, specific accounting degrees are preferred, while in others, any undergraduate degree is acceptable.

- Professional Exams:

- The exams are typically divided into multiple levels, such as:

- Foundation Level: Basic principles of accounting, economics, and business laws.

- Intermediate Level: More advanced subjects, including financial management, accounting standards, and taxation.

- Final Level: Specialized and advanced topics like strategic financial management, advanced auditing, and corporate laws.

- The exams are known for their difficulty, requiring extensive study and preparation.

- The exams are typically divided into multiple levels, such as:

- Practical Experience:

- Candidates must complete a period of practical training or articleship, usually ranging from 2 to 3 years. This experience must be gained under the supervision of a qualified Chartered Accountant.

- The practical training involves working on real-world financial tasks, such as auditing, tax planning, financial reporting, and business advisory services.

Core Subjects and Skills

Chartered Accountancy covers a wide range of subjects, including:

- Financial Accounting: Preparation and analysis of financial statements.

- Management Accounting: Cost management, budgeting, and performance evaluation.

- Auditing and Assurance: Examining financial records to ensure accuracy and compliance.

- Taxation: Understanding and applying tax laws for individuals and businesses.

- Financial Management: Corporate finance, investment analysis, and risk management.

- Business Laws and Ethics: Legal aspects of business operations and professional ethics.

Career Opportunities

Chartered Accountants have diverse career opportunities, including:

- Public Practice: Providing audit, tax, and consulting services to clients.

- Corporate Sector: Working as financial managers, controllers, CFOs, or in other executive roles.

- Government and Public Sector: Roles in regulatory bodies, government accounting departments, and public sector enterprises.

- Academia and Research: Teaching at universities or conducting research in finance and accounting.

Professional Development and Ethics

- Continuing Professional Development (CPD): CAs are required to continually update their knowledge and skills through ongoing education and training.

- Ethical Standards: Adherence to a strict code of ethics is mandatory, ensuring integrity, objectivity, and professionalism in all activities.

Global Mobility and Recognition

The CA qualification is highly portable, allowing professionals to work in various countries, often with reciprocal agreements between different institutes. This global recognition makes Chartered Accountants highly sought after worldwide.

Challenges and Rewards

While the journey to becoming a Chartered Accountant is challenging due to the demanding exams and extensive training, the rewards are substantial. CAs enjoy high earning potential, respected professional status, and diverse career opportunities.

4. Company Secretary (CS)

A Company Secretary (CS) is a key managerial personnel in a company who acts as a bridge between the board of directors and the various stakeholders of the company, ensuring that the company adheres to legal and regulatory requirements. The role of a CS is multifaceted, involving a mix of compliance, governance, advisory, and administrative duties.

Duration: Varies (generally 3-5 years)

Key Responsibilities

- Compliance and Governance:

- Regulatory Compliance: Ensuring that the company complies with the provisions of the Companies Act, securities laws, and other relevant legislation. This includes filing annual returns, financial statements, and other statutory documents with regulatory authorities.

- Corporate Governance: Advising the board on best practices in corporate governance and ensuring that the board’s decisions are implemented in accordance with the laws and regulations.

- Advisory Role:

- Board Meetings: Organizing board meetings, preparing agendas, and circulating board papers. The CS also takes minutes of the meetings, ensuring that all discussions and decisions are accurately recorded.

- Legal Advice: Providing legal guidance to the board and senior management on various issues, including mergers and acquisitions, joint ventures, and other strategic decisions.

- Administrative Duties:

- Record Keeping: Maintaining statutory registers, records of shareholders, directors, and other key documents.

- Communication: Acting as the primary point of contact between the company and its shareholders, handling correspondence, and ensuring timely dissemination of information.

- Stakeholder Management:

- Investor Relations: Managing relationships with investors and analysts, ensuring transparency and effective communication regarding the company’s performance and strategy.

- Public Relations: Handling media relations, public announcements, and ensuring the company’s image is positively represented.

- Risk Management:

- Identifying Risks: Helping the company identify potential risks and implementing systems to manage these risks effectively.

- Crisis Management: Playing a key role in the company’s crisis management team, ensuring that the company can respond effectively to any crisis situation.

Qualifications and Skills

To become a Company Secretary, one must complete a specialized course and training offered by professional bodies such as the Institute of Company Secretaries of India (ICSI), the Institute of Chartered Secretaries and Administrators (ICSA) in the UK, or equivalent organizations in other countries. The qualification process typically includes:

- Foundation Course: Basic understanding of business, finance, and company law.

- Executive Program: Intermediate knowledge of legal and management principles.

- Professional Program: Advanced study of company law, governance, and related subjects.

- Training: Practical training and internships with companies to gain hands-on experience.

Essential skills for a CS include:

- Legal Knowledge: In-depth understanding of corporate laws and regulations.

- Attention to Detail: Meticulousness in maintaining records and ensuring compliance.

- Communication Skills: Excellent written and verbal communication skills to interact effectively with the board, shareholders, and regulatory bodies.

- Analytical Skills: Ability to analyze complex legal and financial information and provide sound advice.

- Ethical Judgment: Upholding the highest standards of ethics and integrity in all dealings.

Importance in Corporate Structure

A Company Secretary plays a crucial role in the smooth functioning of a company. By ensuring compliance and good governance, they help protect the company from legal issues and enhance its reputation. Their advisory role ensures that the board can make informed decisions, and their administrative duties ensure that the company runs efficiently. In essence, a Company Secretary is a cornerstone of the corporate governance framework, contributing significantly to the company’s success and sustainability.

5. Cost and Management Accountancy (CMA)

Cost and Management Accountancy (CMA) is a specialized branch of accounting focused on the internal financial management of organizations. Unlike general accounting, which primarily deals with the preparation of financial statements for external stakeholders, CMA emphasizes the use of financial information for internal decision-making, planning, and control.

Historical Background

The concept of cost accounting dates back to the industrial revolution when businesses sought ways to control costs and improve efficiency. Over the years, it evolved into a more comprehensive discipline encompassing various aspects of management and strategic planning.

Scope and Importance

- Cost Control and Reduction: CMAs play a crucial role in identifying areas where costs can be controlled or reduced without compromising the quality or efficiency of operations.

- Budgeting and Forecasting: They help in preparing budgets and financial forecasts, ensuring that resources are allocated efficiently and future financial performance is projected accurately.

- Decision Making: CMAs provide detailed cost information and analysis, aiding management in making informed decisions about pricing, production processes, and investment opportunities.

- Performance Evaluation: They develop and implement performance measurement systems to evaluate the efficiency and profitability of different departments and projects.

- Strategic Planning: CMAs are involved in long-term strategic planning, helping to set financial goals and devise strategies to achieve them.

Key Areas of CMA

- Cost Accounting: Involves tracking and analyzing costs associated with production, including direct materials, labor, and overheads.

- Management Accounting: Focuses on providing information and analysis to support management in planning, controlling, and decision-making.

- Financial Management: Encompasses the management of the company’s finances, including capital structure, investment decisions, and risk management.

- Strategic Management: Integrates financial analysis with strategic planning to guide the organization towards achieving its long-term objectives.

- Performance Management: Involves setting performance targets, measuring actual performance, and implementing corrective actions to align actual performance with targets.

Qualifications and Certification

Becoming a CMA typically involves earning a professional certification from recognized bodies such as the Institute of Cost Accountants of India (ICAI) or the Institute of Management Accountants (IMA) in the USA. The certification process generally includes:

- Educational Requirements: A bachelor’s degree in accounting, finance, or a related field.

- Professional Experience: Relevant work experience in cost and management accounting.

- Examinations: Passing rigorous exams that test knowledge in areas such as financial planning, analysis, control, and professional ethics.

Career Opportunities

CMAs can pursue diverse career paths in various industries, including manufacturing, healthcare, finance, and government. Common roles include:

- Cost Accountant: Specializing in cost analysis and control.

- Management Accountant: Providing financial insights and analysis for managerial decision-making.

- Financial Analyst: Analyzing financial data to support investment decisions.

- Controller: Overseeing accounting operations and ensuring compliance with financial regulations.

- Chief Financial Officer (CFO): Leading the financial strategy and management of the organization.

Challenges and Future Trends

- Technological Advancements: Automation and artificial intelligence are transforming the field, requiring CMAs to adapt and leverage new technologies.

- Globalization: The increasing globalization of businesses necessitates a broader understanding of international financial regulations and practices.

- Sustainability and Ethics: There is a growing emphasis on sustainable business practices and ethical financial management.

Best Courses After 12th Commerce for Job Orientation

After completing 12th commerce, several job-oriented courses can set you on a promising career path. Bachelor of Commerce (B.Com) is a versatile degree providing fundamental knowledge in business, finance, and accounting, paving the way for roles in accounting, banking, and corporate sectors. Bachelor of Business Administration (BBA) focuses on management and entrepreneurial skills, ideal for aspiring managers and business owners. In this competitive world of education most of the after 12th commerce courses list are available and most of the students benefitted with the help of these couses but the Chartered Accountancy (CA) is a prestigious qualification for those aiming to become well carrer options in field of auditors, tax consultants, or financial advisors.

Company Secretary (CS) involves corporate law and governance, leading to roles in legal and compliance departments of companies. Bachelor of Economics (B.Econ) provides insights into economic policies and analysis, suitable for careers in economic research and policy-making. Additionally, courses like Certified Financial Planner (CFP) and Bachelor of Hotel Management (BHM) offer specialized training for careers in financial planning and hospitality management, respectively.

1. Bachelor of Economics (B.Econ)

A Bachelor of Economics (B.Econ) is an undergraduate degree that focuses on the study of economic principles, theories, and practices. Here’s a comprehensive overview:

Core Subjects

- Microeconomics: Analyzes the behavior of individuals and firms in making decisions regarding the allocation of resources and pricing of goods and services.

- Macroeconomics: Examines the economy as a whole, including topics like inflation, unemployment, and economic growth.

- Econometrics: Uses statistical methods to test economic theories and analyze economic data.

- International Economics: Studies the economic interactions between countries, including trade policies, exchange rates, and globalization.

- Development Economics: Focuses on improving the economic conditions of developing countries.

- Public Economics: Examines the role of government in the economy, including taxation, government spending, and public policies.

- Financial Economics: Looks at financial markets and instruments, including investments, risk management, and financial institutions.

Electives and Specializations

Students may choose electives or specializations based on their interests. Some common areas include:

- Environmental Economics

- Health Economics

- Labor Economics

- Urban and Regional Economics

- Behavioral Economics

Skills Developed

- Analytical Skills: Ability to interpret data and economic trends.

- Quantitative Skills: Proficiency in statistical and mathematical analysis.

- Critical Thinking: Evaluating economic policies and their impacts.

- Research Skills: Conducting economic research and analysis.

Career Opportunities

Graduates can pursue careers in various fields, including:

- Finance: Investment banking, financial analysis, and risk management.

- Government: Economic policy, public administration, and research roles.

- Consulting: Providing economic advice to businesses and organizations.

- Academia: Teaching and conducting research in economics.

- International Organizations: Working with entities like the World Bank, IMF, or UN.

Typical Program Structure

- Year 1: Introduction to economics, basic mathematics, and introductory statistics.

- Year 2: Intermediate microeconomics and macroeconomics, econometrics, and economic theory.

- Year 3: Advanced courses in specialized areas, electives, and possibly a research project or thesis.

- Year 4: Advanced electives, capstone projects, internships, or practical experience.

Admission Requirements

- High school diploma or equivalent.

- Strong academic background in mathematics and economics (if applicable).

- Entrance exams or standardized test scores (requirements vary by institution).

Duration

Typically, a Bachelor of Economics program lasts 3 to 4 years, depending on the country and university.

Let me know if you need details on specific universities or additional information!

2. Bachelor of Commerce in Banking and Insurance (B.Com B&I)

Overview: The Bachelor of Commerce in Banking and Insurance (B.Com B&I) is an undergraduate degree that focuses on the principles and practices of banking and insurance. It is designed to provide students with a strong foundation in commerce, financial services, and risk management.

Key Details:

Duration: Typically 3 years.

Eligibility:

- Completion of higher secondary education (12th grade) with a minimum percentage, which may vary by institution.

- Some universities may require passing an entrance exam or interview.

Curriculum Overview:

- Core Subjects:

- Principles of Banking: Introduction to banking operations, types of banks, and their roles in the economy.

- Principles of Insurance: Fundamentals of insurance, types of insurance, and risk management.

- Financial Accounting: Basics of accounting, financial statements, and analysis.

- Business Law: Legal aspects related to business operations, including contracts and regulations.

- Economics: Micro and macroeconomic principles relevant to banking and insurance.

- Investment Management: Basics of investment, portfolio management, and financial markets.

- Risk Management: Techniques and strategies for identifying and managing risks in banking and insurance.

- Electives (may vary by institution):

- Financial Services: Overview of services provided by financial institutions.

- Insurance Law: Detailed study of legal frameworks affecting insurance.

- Banking Operations: In-depth look at banking functions and processes.

- Corporate Finance: Financial management within corporations.

- International Banking: Global banking practices and regulations.

- Practical Training:

- Internships: Practical experience in banks or insurance companies.

- Projects: Research and case studies related to banking and insurance.

- Assessment:

- Examinations: Written exams at the end of each semester or year.

- Assignments and Projects: Regular coursework to apply theoretical knowledge.

- Career Opportunities:

- Banking Sector: Roles such as bank officer, loan officer, credit analyst, or relationship manager.

- Insurance Sector: Positions such as insurance agent, underwriter, claims adjuster, or risk assessor.

- Financial Services: Jobs in investment firms, financial planning, and consultancy.

- Further Studies: Opportunities for pursuing postgraduate degrees like M.Com, MBA, or professional certifications (e.g., CFA, CFP).

3. Bachelor of Management Studies (BMS)

The Bachelor of Management Studies (BMS) is an undergraduate degree program that focuses on developing managerial and business skills. It’s designed to provide students with a strong foundation in business management principles, preparing them for various roles in the business world or for further studies in management.

Here’s a detailed overview:

Program Structure

- Duration: Typically 3 years, divided into 6 semesters.

- Core Subjects:

- Principles of Management

- Financial Accounting

- Business Economics

- Marketing Management

- Human Resource Management

- Organizational Behavior

- Business Law

- Strategic Management

- Operations Management

- Entrepreneurship

- Electives: Depending on the institution, students may have options to choose electives such as International Business, Digital Marketing, Investment Management, etc.

- Projects and Internships: Many programs include practical components like internships and project work to provide real-world experience.

Key Skills Developed

- Leadership and Teamwork: Understanding how to lead and work effectively in teams.

- Analytical Skills: Ability to analyze data and make informed decisions.

- Communication Skills: Enhancing both written and verbal communication skills.

- Problem-Solving: Developing strategies to tackle business challenges.

- Financial Acumen: Understanding financial statements and budgeting.

Career Opportunities

Graduates of BMS can pursue careers in various fields, including:

- Marketing: Roles in advertising, market research, and sales.

- Finance: Financial analysis, banking, and investment.

- Human Resources: Recruitment, training, and employee relations.

- Operations Management: Overseeing production and service delivery.

- Entrepreneurship: Starting and managing their own business.

Further Studies

Many BMS graduates opt for further studies such as:

- Master of Business Administration (MBA)

- Postgraduate Diplomas in Management

- Specialized certifications in areas like finance, marketing, or human resources.

Admission Requirements

- Eligibility: Completion of higher secondary education (10+2) or equivalent.

- Entrance Exams: Some institutions may require entrance exams like CET, JEE, or their own internal tests.

- Application Process: Typically involves submission of academic transcripts, entrance exam scores (if applicable), and personal statements or interviews.

Institutions Offering BMS

BMS programs are offered by various universities and colleges worldwide, including:

- India: Universities like Mumbai University, Delhi University, and others.

- International: Institutions in countries like the USA, UK, Canada, Australia, and more.

The specifics can vary depending on the institution and country, so it’s always a good idea to check the exact details of the program you’re interested in.

4. Bachelor of Finance and Accounting (BFA)

Overview: The Bachelor of Finance and Accounting (BFA) is an undergraduate degree program designed to provide students with a comprehensive understanding of finance and accounting principles. Here’s a general outline of what you might expect from such a program:

Core Curriculum

- Introduction to Accounting

- Financial Accounting

- Managerial Accounting

- Finance Principles

- Corporate Finance

- Investment Analysis

- Financial Markets and Institutions

- Business Law and Ethics

- Legal Environment of Business

- Business Ethics

- Economics

- Microeconomics

- Macroeconomics

- Quantitative Methods

- Statistics for Business

- Business Analytics

- Financial Reporting and Analysis

- Advanced Financial Accounting

- International Financial Reporting Standards (IFRS)

- Management and Strategy

- Principles of Management

- Strategic Management

- Taxation

- Personal Taxation

- Corporate Taxation

- Auditing

- Internal Auditing

- External Auditing

- Financial Planning

- Personal Financial Planning

- Risk Management

Electives (may vary by institution)

- Advanced Investment Strategies

- Forensic Accounting

- International Finance

- Real Estate Finance

- Financial Derivatives

- Behavioral Finance

Practical Experience

- Internships: Many programs include internships or cooperative education opportunities to gain real-world experience.

- Capstone Projects: Some programs require a final project or thesis that involves applying knowledge to practical problems.

Skills Developed

- Analytical Skills: Ability to analyze financial statements and data.

- Technical Skills: Proficiency in accounting software and financial modeling.

- Communication Skills: Effective reporting and presentation of financial information.

- Ethical Judgment: Understanding of ethical issues in finance and accounting.

Career Opportunities

Graduates with a BFA can pursue various career paths, including:

- Financial Analyst

- Accountant

- Auditor

- Tax Advisor

- Financial Planner

- Investment Banker

- Corporate Treasurer

Certifications and Further Education

- Certifications: Graduates often pursue certifications such as CPA (Certified Public Accountant) or CFA (Chartered Financial Analyst).

- Graduate Studies: Many also choose to continue their education with a Master’s in Finance, Accounting, or an MBA.

Program Duration

Typically, the program takes about four years to complete, assuming a full-time study schedule.

Accreditation

It’s important to ensure that the program is accredited by a recognized accrediting body to ensure the quality and recognition of the degree.

Specialized and Emerging Courses After 12th Commerce

Specialized and emerging courses after 12th commerce offer students diverse opportunities to build careers in various fields. These programs include traditional subjects like Accounting, Finance, and Business Administration, as well as innovative disciplines such as Digital Marketing, Data Analytics, and International Business. Specialized and best course after 12 commerce in areas like Chartered Accountancy (CA), Company Secretary (CS), and Cost and Management Accountancy (CMA) provide in-depth knowledge and professional certification. Meanwhile, emerging courses in e-commerce, fintech, and entrepreneurship cater to the evolving market demands and technological advancements. These options enable commerce students to tailor their education to specific career goals and industry trends.

1. Bachelor of Business Economics (BBE)

Overview: BBE combines economic theories with business practices, focusing on micro and macroeconomic principles, econometrics, and business policies.

Duration: 3 years

Career Opportunities: Graduates can work as business analysts, economic consultants, policy advisors, and in various roles in economic research.

2. Bachelor of Financial Markets (BFM)

Overview: BFM focuses on financial markets, trading, investment analysis, and portfolio management.

Duration: 3 years

Career Opportunities: Graduates can work in stock exchanges, investment firms, financial consulting, and portfolio management.

3. Bachelor of Business Administration in International Business (BBA IB)

Overview: This course focuses on international business practices, global trade policies, and cross-cultural management.

Duration: 3 years

Career Opportunities: Graduates can work in multinational corporations, export-import firms, international marketing, and global supply chain management.

Career Options After 12th Commerce

After completing 12th Commerce, students have a wide array of career options to explore. They can pursue traditional paths like Bachelor of Commerce (B.Com), Bachelor of Business Administration (BBA), or Bachelor of Economics (BE). For those interested in finance and accounting, Chartered Accountancy (CA), Cost and Management Accountancy (CMA), and Company Secretary (CS) are popular choices. Additionally, careers in banking, investment, and insurance sectors are promising.

Commerce students always looking for best career after 12th but also venture into professional courses like Law (LLB), Hotel Management, and Journalism. With the rise of digital marketing and e-commerce, careers in these fields have also gained significant traction. Pursuing higher education, such as MBA or Master’s degrees in specialized fields, further expands their career prospects.

Below are list of courses:-

1. Finance and Banking

Overview: The finance and banking sector offers numerous career opportunities for commerce graduates. This sector requires professionals with strong analytical and numerical skills.

Job Roles: Financial Analyst, Investment Banker, Loan Officer, Bank Manager, Risk Manager

Courses to Consider: B.Com, BBA, B.Com B&I, CA, CFA

2. Accounting and Auditing

Overview: Accounting and auditing are core areas of commerce. Professionals in this field ensure the accuracy of financial statements and compliance with regulations.

Job Roles: Accountant, Auditor, Tax Consultant, Internal Auditor

Courses to Consider: B.Com, CA, CMA, BFA

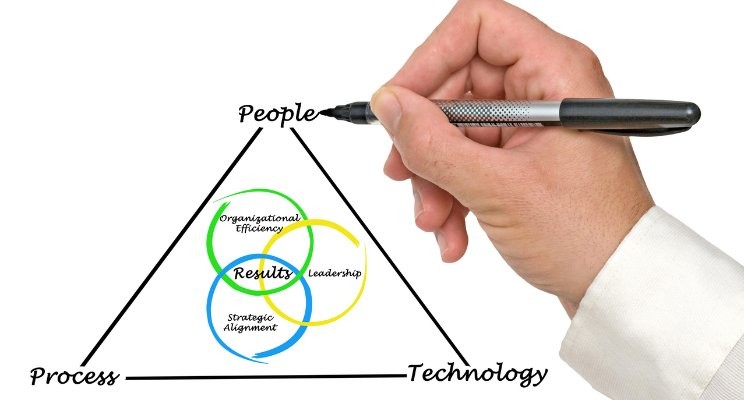

3. Management and Administration

Overview: Management and administration roles are crucial for the smooth functioning of businesses and organizations. These roles involve planning, organizing, and overseeing business operations.

Job Roles: Business Manager, HR Manager, Marketing Manager, Operations Manager

Courses to Consider: BBA, BMS, MBA

4. Marketing and Advertising

Overview: The marketing and advertising sector is dynamic and creative, focusing on promoting products and services to target audiences.

Job Roles: Marketing Executive, Brand Manager, Digital Marketing Specialist, Advertising Consultant

Courses to Consider: BBA, BMS, Bachelor of Marketing, MBA in Marketing

5. Entrepreneurship

Overview: Entrepreneurship involves starting and managing new business ventures. This career path is suitable for those with innovative ideas and a risk-taking attitude.

Job Roles: Entrepreneur, Startup Founder, Business Consultant

Courses to Consider: BBA, BMS, Bachelor of Entrepreneurship, MBA

Conclusion

The field of commerce offers a wealth of opportunities for students after completing their 12th standard. From traditional degrees like B.Com and CA to specialized courses like BFM and BBE, there are numerous paths to explore. Choosing the right course depends on your interests, career goals, and strengths. Whether you aim for best courses after 12th become a financial analyst, a corporate lawyer, a business manager, or an entrepreneur, commerce provides the knowledge and skills to succeed in a variety of professional domains. By carefully selecting a course that aligns with your aspirations, you can pave the way for a rewarding and successful career.

Frequently Asked Questions

Which is the best course to study after 12th?

Ans- The best course to pursue after 12th commerce depends on your interests, career goals, and strengths. Here are some popular options:

- Bachelor of Commerce (B.Com): A general degree in commerce, providing a strong foundation in various subjects like accounting, finance, and economics.

- Bachelor of Business Administration (BBA): Focuses on management and business principles, preparing students for managerial roles.

- Chartered Accountancy (CA): A professional course for becoming a chartered accountant, involving rigorous training and exams.

- Company Secretary (CS): A professional course for becoming a company secretary, focusing on corporate law and governance.

- Bachelor of Economics (B.Econ): Concentrates on economic theories, policies, and analysis.

- Bachelor of Management Studies (BMS): Emphasizes management skills and business strategies.

- Bachelor of Law (LLB): For those interested in pursuing a career in law.

- Cost and Management Accountancy (CMA): A professional course focusing on cost accounting and management.

What should I study after 12th with high salary?

Ans- After completing 12th commerce, you can pursue the following courses for high salary potential:

- Chartered Accountancy (CA)

- Bachelor of Commerce (B.Com) with specialization

- Company Secretary (CS)

- Cost and Management Accountancy (CMA)

- Bachelor of Business Administration (BBA)

- Bachelor of Economics (BE)

- Law (LLB)

- Certified Financial Planner (CFP)

- Bachelor of Management Studies (BMS)

- Digital Marketing

Which course is best for the future?

Ans- The best course for the future depends on your interests, strengths, and career goals. However, fields like Data Science, Artificial Intelligence, Cybersecurity, and Renewable Energy are highly promising due to growing demand and technological advancements.

Which course is best for a job?

Ans- The best course for a job depends on your interests and the industry you’re targeting. Here are some high-demand fields with corresponding courses:

- Technology: Computer Science, Data Science, Cybersecurity

- Healthcare: Nursing, Medical Assistant, Healthcare Administration

- Business: Business Administration, Marketing, Finance

- Engineering: Mechanical, Electrical, Civil Engineering

- Trades: Plumbing, Electrician, Welding

Choosing a course aligned with growing industries and your personal interests will enhance job prospects.